How to Build Fintech App Development with a Detailed Guide?

Are you planning to develop a fintech app but feel unsure of where to start or who to hire? Don’t worry—we’ve got you covered. This blog answers all your questions and provides detailed guidance on fintech app development. Discover the essentials of financial services, the right technology to use, design ideas, and much more.

As the internet era has revolutionalized the fintech app demands whether it transfers the money. We all talk about everything in detail, what all the steps you need to build a fintech app. We are known to build the best apps for Fintech App Development Company.

The total value of investments in fintech companies worldwide from 2010 to the first half of 2023 Statista.

Table of Content of Fintech App Development?

What Is FinTech?

What Is FinTech App Development?

Benefits of Fintech App

Key Features of Fintech Apps

Types of Fintech App

How to Start Working to Build a Fintech App?

- Addons to make money from fintech app

- Types of API to be used to build an App

- Conclusion

What is Fintech?

“Fintech” merges “financial” and “technology,” indicating the use of technology for innovative financial services. Essentially, fintech involves the application of modern technology to enhance and automate various aspects of financial services and processes. The objective is to enhance the efficiency, accessibility, and user-friendliness of financial services.

Fintech companies leverage a range of technologies, including mobile applications, artificial intelligence, blockchain, data analytics, and cloud computing, to create new and improved financial products and services. These innovations can span a wide array of financial activities, from banking and payments to investing, insurance, and lending.

The fintech industry has emerged as a disruptive force, challenging traditional financial institutions and introducing competition and innovation. Some key areas within fintech include:

- Digital Payments: Fintech companies have introduced digital payment solutions, mobile wallets, and peer-to-peer payment platforms that provide convenient and fast alternatives to traditional payment methods.

- Online Lending: Fintech lending platforms connect borrowers directly with lenders, streamlining the loan application and approval process. This can include peer-to-peer lending, crowdfunding, and other online lending models.

- Robo-Advisors: Automated investment platforms use algorithms and artificial intelligence to provide investment advice and manage investment portfolios, often at a lower cost than traditional financial advisors.

- Blockchain and Cryptocurrencies: Fintech has played a significant role in the development and adoption of blockchain technology and cryptocurrencies like Bitcoin and Ethereum, offering new ways to transfer and store value.

- Insurtech: Technology is applied to the insurance industry to improve processes, enhance risk assessment, and offer more personalized insurance products. This includes the use of data analytics and IoT (Internet of Things) devices.

- Regtech: Regulatory technology focuses on using technology to help companies comply with regulations more efficiently. This can involve tools for regulatory reporting, compliance monitoring, and identity verification.

- Personal Finance Management: Fintech apps provide individuals with tools for budgeting, expense tracking, and financial planning, empowering users to take control of their finances.

- Open Banking: Fintech encourages the sharing of financial information among different financial institutions securely, promoting collaboration and allowing users to access a broader range of financial services.

Fintech is a dynamic and evolving field that continues to shape the future of finance, offering solutions that cater to the changing needs and expectations of consumers and businesses.

What Is Fintech App Development?

Fintech app development involves creating applications that utilize technology to deliver financial services or solutions. “Fintech” is a portmanteau of “financial technology,” and fintech apps are designed to streamline, enhance, or innovate various aspects of finance, banking, investment, and related services. Fintech app development can cover a wide range of functionalities and services, and it often involves the use of advanced technologies to improve financial processes.

Here are key aspects and considerations in fintech app development:

- Identifying Purpose and Target Audience: Define the purpose of the fintech app. It could be related to payments, banking, investing, budgeting, insurance, or other financial services. Identify the target audience for the app, such as consumers, businesses, or a specific demographic.

- Understanding Regulatory Compliance: Be aware of and comply with financial regulations and standards applicable to the regions in which the app will operate.

- Security and Privacy: Prioritize robust security measures to protect sensitive financial information and ensure user privacy.

- User Experience (UX) Design: Design an intuitive and user-friendly interface to enhance the overall user experience. Consider the user journey, onboarding process, and ease of navigation.

- Integration with Financial Institutions: Establish secure connections with financial institutions to enable features like account linking, transaction retrieval, and fund transfers.

- Payment Processing: If applicable, incorporate secure payment processing functionalities, including online payments, mobile wallets, and peer-to-peer transactions.

- Investment Features: If the app involves investments, include features like stock trading, robo-advisors, or cryptocurrency trading.

- Data Analytics and Insights: Implement tools for data analytics to provide users with insights into their financial activities, spending patterns, and investment performance.

- Notification Systems: Include a notification system to alert users about transactions, account activities, and important updates.

- Multi-platform Development: Develop the app for multiple platforms, such as iOS and Android, to reach a broader audience.

- Scalability: Design the app architecture with scalability in mind, allowing it to handle increased user loads and additional features as the user base grows.

- Testing and Quality Assurance: Conduct thorough testing to ensure the app’s functionality, security, and performance meet high standards.

- Continuous Improvement: Regularly update the app based on user feedback, technology advancements, and changes in regulatory requirements.

- Marketing and User Acquisition: Develop a marketing strategy to promote the app and attract users.

- Customer Support: Implement a robust customer support system to address user queries and issues promptly.

Fintech app development requires a combination of financial expertise, technology proficiency, and a deep understanding of user needs. It’s essential to stay informed about industry trends and innovations to create a competitive and effective fintech solution.

Benefits of Fintech App:

A Fintech app, or financial technology application, is a software application that uses technology to provide or enhance financial services. These apps leverage various technologies such as mobile devices, artificial intelligence, blockchain, and data analytics to offer innovative solutions in the financial sector. Fintech apps cover a broad range of services, including mobile banking, digital payments, investing, insurance, lending, and more.

Here are some benefits of Fintech apps:

- Convenience: Fintech apps provide users with convenient access to financial services from their mobile devices or computers. This eliminates the need to visit physical bank branches, saving time and effort.

- Accessibility: Fintech apps often reach underserved or unbanked populations, providing financial services to individuals who may not have easy access to traditional banking infrastructure.

- Cost-Effectiveness: Many Fintech solutions are designed to be more cost-effective than traditional financial services. Lower overhead costs, streamlined processes, and automated services can result in reduced fees and costs for users.

- Speed: Fintech apps often offer faster transaction processing and service delivery compared to traditional financial institutions. This speed is particularly evident in areas such as digital payments and online lending.

- Innovation: Fintech companies are known for their innovative approaches to financial services. They introduce new technologies and business models that can drive industry-wide innovation, encouraging traditional financial institutions to adapt and improve.

- Financial Inclusion: Fintech apps contribute to financial inclusion by providing services to individuals who are underserved or excluded from traditional banking systems. This includes people in remote areas, those without a banking history, and those with limited access to financial resources.

- Personalization: Fintech apps often use data analytics and artificial intelligence to analyze user behavior and preferences. This enables the customization of financial services, such as personalized investment advice and targeted product recommendations.

- Security: Fintech companies prioritize the security of financial transactions and user data. They implement robust encryption, authentication, and other security measures to protect users’ financial information.

It’s important to note that while Fintech apps offer numerous benefits, users should also be mindful of security considerations and ensure that they are using reputable and secure platforms. Additionally, regulations and standards may vary across different regions, so users should be aware of the regulatory environment when using Fintech services.

Key Features of Fintech Apps:

The key features of a fintech app can vary depending on its specific purpose and the financial services it offers. However, some common features are often found in many fintech applications. Here are some key features:

1) User Authentication: Secure login methods, such as biometric authentication (fingerprint or facial recognition) or two-factor authentication, to ensure the security of user accounts.

2) Account Management: View and manage account balances and transaction history. Transfer funds between accounts or to other users.

3) Digital Payments: Support for various payment methods, including peer-to-peer transfers, mobile wallet integration, and contactless payments. Payment history and transaction details.

4) Budgeting and Expense Tracking: Tools for budget creation and monitoring spending habits. Categorization of expenses and income for better financial tracking.

5) Investment Features: Portfolio tracking and management for investment apps, Access to real-time market data and financial news, and Automated investment tools, such as robo-advisors.

6) Lending and Borrowing: Loan application and approval processes, Loan repayment management Interest rate information, and loan terms.

7) Financial Planning: Tools for setting financial goals, Retirement planning and investment advice, and Calculators for savings, investments, and loans.

8) Security Features: Encryption and secure protocols to protect user data, Account alerts and notifications for suspicious activity, and Options to lock or freeze accounts in case of a lost or stolen device.

9) Customer Support: In-app customer support chat or messaging, FAQs and help guides, and Contact information for customer service.

10) Regulatory Compliance: Compliance with financial regulations industry standards disclosures and terms of service to ensure transparency.

11) Personalization: Customizable settings based on user preferences and personalized recommendations for financial products or services.

12) Integration with Other Services: Integration with third-party financial tools or services and API support for connecting with other apps or platforms.

13) Offline Access: Basic functionality available even without an internet connection and Offline transaction history and account balance.

14) Notification and Alerts: Alerts for account activity, upcoming payments, or financial milestones and push notifications for important updates.

15) Comprehensive Reporting: Detailed financial reports and statements graphs and visualizations for a better understanding of financial data.

16) Cross-Platform Compatibility: Availability on multiple platforms, such as iOS, Android, and web browsers.

These features contribute to creating a comprehensive and user-friendly fintech app that meets the needs of consumers in managing their finances, investing, and conducting various financial transactions. Fintech apps need to balance innovation with security and regulatory compliance to provide a reliable and trustworthy service to users.

Want To Validate Your Fintech App Development Idea? Want To Get A Free Consultation From An Expert?

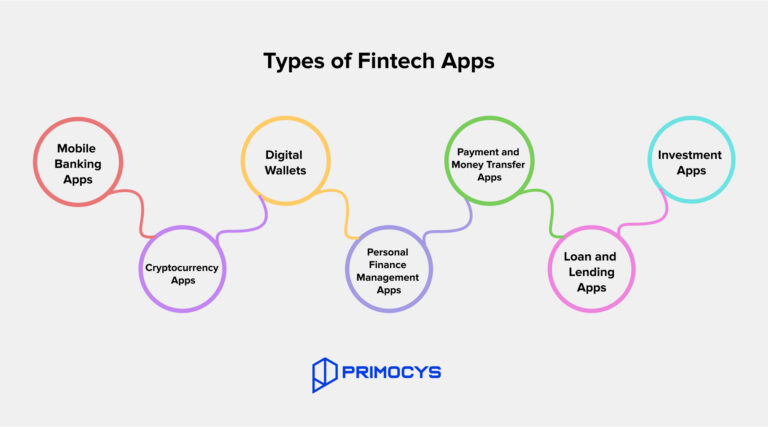

Types of Fintech App

Fintech apps cover a broad spectrum of financial services and activities, each serving a specific purpose or addressing particular needs. Here are some common types of fintech apps:

Here are some of the types of fintech apps you can see in the below image:

1) Mobile Banking Apps:

Offer users the ability to manage their bank accounts, check balances, transfer funds, and pay bills through a mobile interface.

2) Digital Wallets:

Enable users to store and manage their payment information securely, make online and in-store purchases, and often support features like loyalty programs and rewards.

3) Payment and Money Transfer Apps:

Facilitate peer-to-peer payments, money transfers, and online payments. Examples include PayPal, Venmo, and Cash App.

4) Investment Apps:

Provide platforms for users to invest in stocks, bonds, mutual funds, and other financial instruments. Some apps offer robo-advisory services, automating investment decisions based on user preferences and risk tolerance.

5) Cryptocurrency Apps:

Allow users to buy, sell, and manage cryptocurrencies. These apps may also include features like cryptocurrency wallets and price tracking.

6) Personal Finance Management Apps:

Assist users in budgeting, expense tracking, and financial planning. They often provide insights into spending habits and financial goals.

7) Loan and Lending Apps:

Facilitate borrowing and lending processes, connecting borrowers with lenders. This category includes peer-to-peer lending platforms and online loan services.

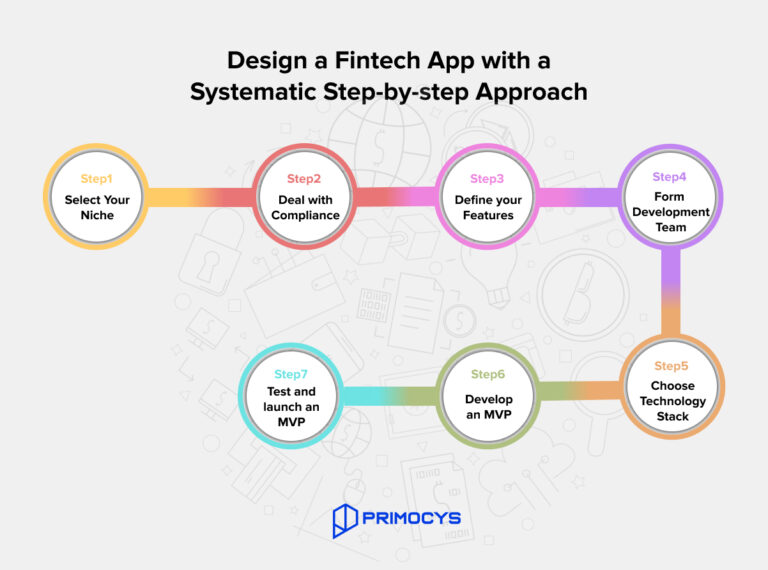

How to Start working to Build a Fintech App

- Select Your Niche:

When the developer team start working on the fintech app, they need to first determine the niche of financial institutions. It means that the developer has to figure out what type of app the client wants, and what’s their specific requirement, as none of the clients want the same replica app that is already there in the market. So for this reason first determine the niche.

2. Deal with Compliance:

It is crucial for the client to have a comprehensive understanding of all legal regulations and to thoroughly examine the implementation and integration of KYC, AML, and other financial protection systems to ensure compliance. Additionally, it is important to consider privacy laws such as CCPA, GDPR, PIA, LGPD, and others to safeguard the user’s financial data on the application or restrict access to it.

Furthermore, it is essential to thoroughly research and familiarize oneself with the privacy laws specific to the target audience’s region. For instance, although the USA lacks a FinTech regulator, it must adhere to numerous state and federal laws. In such cases, it is imperative to exercise caution regarding legal requirements, as any system breach or information leakage could result in liability and potentially hefty fines.

3. Define your Feature:

The selection of features for your FinTech application development will depend on the specific niche you choose to focus on. By understanding your target audience, you can determine the necessary features they will require to accomplish tasks within your application. However, certain fundamental features and functionalities are commonly found in most FinTech applications. These can serve as a starting point for the development of your FinTech app. As your application evolves, you can expand upon the features and functionalities that resonate with your target audience, thereby enhancing their overall experience. Here are several typical features that you may consider incorporating into your FinTech application:

1. Robust Security Measures: Implement highly secure login options such as fingerprint, facial, or voice recognition to ensure the protection of user data.

2. Push Notifications: Enable the delivery of real-time updates and notifications to keep users informed about important financial activities or events.

3. Budget and Savings Tracking: Provide users with the ability to monitor and manage their budgets, as well as track their savings progress.

4. Financial Operations: Include essential financial operations such as money transfers, digital payments, balance checks, and other related functionalities.

5. Card Number and QR Code Scanning: Allow users to conveniently scan card numbers or QR codes for seamless transactions and account linking.

6. Virtual Assistant or AI-powered Chatbot: Integrate a virtual assistant or chatbot powered by artificial intelligence to assist users with their financial inquiries and provide personalized recommendations.

7. Unconventional Financial Services: Offer unique financial services like purchasing gift cards, making donations, or accessing other non-traditional financial options.

8. Cashback, Offers, and Deals: Incorporate features that provide users with cashback rewards, exclusive offers, and deals to enhance their overall financial experience.

By including these common features within your FinTech application, you can provide a solid foundation for your users while also catering to their specific needs and preferences.

4. Form Development Team

To ensure the success of your finance Mobile App Development, it is imperative to assemble the right team of experts or vendors. Outsourcing software development services can be a practical solution as it saves both time and money, providing access to the best resources available and allowing for easy scaling up or down as needed.

Alternatively, setting up an in-house development team can provide you with the technical expertise necessary to address any development-related queries. You have the flexibility to determine the team size, milestones, and deliverables based on your project requirements, and can choose to begin development with either cross-platform tools like Flutter or React Native or native mobile application development. You can interview and hire resources for as long as you need them.

The composition of a cross-platform FinTech app development team typically includes

- A Frontend and a Backend

- Business Analyst

- Project Manager

- Designer

- QA Specialist

- DevOps Engineer

On the other hand, a native FinTech app development team consists of these:

- Android developer and iOS developer

- Business Analyst

- Project Manager

- Designer

- QA Specialist

- DevOps Engineer

5. Choose Technology Stack

To ensure that your project meets the requirements, it is crucial to carefully consider the technology, framework, and tool combination that you will use. The selection should be based on the specific needs of your project and the proficiency of your team. It is important to have a technology stack that can provide optimal performance, scalability, and maintainability. In the development of fintech apps, some of the commonly used technologies include:

Backend Node.js, Python (Django or Flask), Ruby on Rails, Java, and.NET. Frontend React, Angular, Vue.js, and others Swift or Objective-C for iOS, Kotlin or Java for Android. Database PostgreSQL, MySQL, MongoDB, and Firebase Cloud and infrastructure AWS, Google Cloud Platform, Microsoft Azure Security SSL/TLS, OAuth, JWT, and encryption libraries 6. Develop an MVP

When embarking on the FinTech app development, it would be prudent to commence with a Minimum Viable Product (MVP). This strategic move allows you to assess the market potential of your idea while minimizing development costs. An MVP typically encompasses only the fundamental features of your app, enabling swift and cost-effective development.

Should the MVP prove successful in the market, you can then contemplate incorporating more advanced features to enrich the user experience and provide added value to your customers. Adopting this incremental approach will assist you in constructing a triumphant FinTech app that caters to the requirements of your target audience while adhering to your budget.

7. Test and Launch MVP

Prior to releasing your financial software to the market, it is imperative to conduct thorough testing and release an initial version. This crucial step ensures that your program is fully prepared for public usage and delivers a seamless user experience. Once your application is launched, utilize analytics and monitoring tools to evaluate its usage, performance, and other essential metrics. This valuable information will aid you in making informed decisions regarding future upgrades, enhancements, and marketing strategies.

Addons to Make Money from Fintech App:

FinTech applications have the ability to utilize various monetization techniques depending on their intended audience and type. Here are some of the most commonly used strategies by FinTech apps:

- Subscription Model – Users are required to pay a monthly or yearly fee to access premium features or services of the app.

- Freemium Model – FinTech apps offer a free version of their app with limited features, and users can upgrade to the paid version to access additional features or services.

- Transaction Fees – FinTech apps earn revenue by charging transaction fees for payment processing, foreign exchange, or investment management services.

- Advertising – FinTech apps can generate revenue by displaying targeted advertisements to users based on their financial activity and preferences.

- Referral Programs – Some FinTech apps reward users who refer friends or family members to the app.

- Data Monetization – FinTech apps can monetize user data by selling insights or analytics to third-party companies.

By utilizing these monetization strategies, FinTech app developers can generate revenue and maintain their business models while providing users with valuable services.

A range of API types can be Leveraged for the Purpose of Financial App.

Building a Fintech app involves integrating various types of APIs to enable different functionalities and services. Here are the key types of APIs that are commonly needed for developing a comprehensive Fintech application:

Payment APIs:

Payment APIs play a crucial role in facilitating secure and seamless financial transactions in various applications, including Fintech. These APIs facilitate the transfer of payment information between a website or mobile app and the payment processor. They often handle tasks like encryption, authorization, and settlement of transactions. Here are some common types of Payment APIs:

- Stripe: Stripe is a popular payment gateway that provides a robust API for processing online payments. The Stripe API allows developers to integrate payment functionality directly into websites and applications, enabling businesses to accept payments securely and efficiently. Stripe supports various payment methods, including credit cards, debit cards, digital wallets (e.g., Apple Pay, Google Pay), and bank transfers.

- Paypal: PayPal provides a comprehensive set of APIs for integrating its payment gateway into websites and applications.PayPal supports various payment methods, including credit cards, PayPal accounts, and alternative payment methods.

Direct Bank Payment APIs:

Allow users to make payments directly from their bank accounts. These APIs initiate bank transfers and enable ACH (Automated Clearing House) transactions. Some of the common service providers are:

1. Plaid: Plaid is a financial technology company that provides a platform for connecting applications with users’ bank accounts. The company’s primary offering is a set of APIs (Application Programming Interfaces) that allow developers to access and integrate with banking and financial data securely. Plaid serves as an intermediary between financial institutions and developers, enabling the creation of various Fintech applications and services.

Plaid connects applications to users’ bank accounts, allowing them to retrieve information such as account balances, transaction histories, and other financial data.

2. Dwolla: Dwolla is a financial technology company that provides a secure and programmable platform for businesses to build customized payment solutions and facilitate money transfers. Dwolla’s platform allows businesses to integrate its APIs (Application Programming Interfaces) to enable various financial transactions, including bank transfers and payments.

Dwolla specializes in ACH transfers, which are electronic bank-to-bank transfers. This allows users to move money between bank accounts securely and efficiently.

Conclusion

Building a Fintech app involves careful consideration of various components, technologies, and APIs to deliver a secure, user-friendly, and feature-rich financial application. It requires a strategic approach, a deep understanding of financial regulations, and a commitment to user security. By combining these elements, you can create a Fintech app that not only meets the needs of users but also aligns with industry standards and best practices.

Fintech App Development: Frequently Asked Questions

Want to know more about Financial Mobile App Development? Browse our FAQ to know your query. Or better yet – contact us to get your answers!

What is Fintech app development?

Fintech application development employs advanced technology to deliver financial services and solutions through mobile and web applications.

How Do You Optimize The Cost Of Fintech App Development?

To enhance the cost-effectiveness of creating a financial application, several aspects can be taken into account, including:

1. Precisely delineate your requirements and give priority to essential features.

2. Employ agile development methodologies to ensure efficient iteration and adaptability.

3. Capitalize on existing fintech platforms and APIs to circumvent the need for building everything from the ground up.

4. Contemplate outsourcing development to countries with lower labor costs.

5. Strategize for scalability to accommodate future expansion without the need for extensive modifications.

What challenges are there when developing Fintech applications?

Fintech app development poses various challenges, encompassing adherence to regulatory requirements and security considerations, seamless integration with existing systems, and the presence of fierce competition and market saturation.

How Long Does It Take To Build A Financial App?

The duration needed to develop a financial application is contingent upon various factors such as the intricacy of functionalities, integrations, team magnitude, and development methodology. The timeframe can vary from several months for an application to a year or beyond for intricate applications. Effective planning, allocation of resources, and proficient development techniques can facilitate the smooth progression of the process.

Do You Have Real-Life Experience In Working With Plaid APIs And Similar Other Banking Services?

Plaid serves as a extensively utilized API platform for the integration of banking and financial services. Numerous developers have effectively incorporated Plaid APIs, Dwolla, and various other tools into their business applications, thereby facilitating secure access to banking data and transactions.

What is the process of developing a financial app?

- Create wireframes and prototypes to visualize the app’s layout and functionalities.

- Focus on intuitive navigation, user-friendly interfaces, and responsive design.

- Integrate with third-party services (e.g., payment gateways, financial APIs) for enhanced functionality.

- Implement APIs for data exchange and integration with other systems (if applicable).

3. Development and Testing:

- Choose the right technology stack (programming languages, frameworks, databases).

- Develop core features such as account management, transactions, notifications, etc.

- Conduct thorough testing (unit testing, integration testing, user acceptance testing) to identify and fix bugs.

4. Launch and Marketing:

- Prepare for app store submission (App Store, Google Play) by meeting their guidelines.

- Develop a marketing strategy to promote your app and attract users (e.g., social media, email campaigns).

5. Maintenance and Updates:

- Regularly maintain and update the app to fix bugs, add new features, and ensure compatibility with OS updates. Monitor performance metrics (e.g., user engagement, retention, conversion rates) to track the app’s success.

Which countries does Primocys Company focus on when developing fintech technology?

Our app development service caters to clients in the United States, United Kingdom, Canada, Australia, New Zealand, Europe, and numerous other countries worldwide.