How to Add Plaid API to Your Fintech Application?

If you’re considering developing a fintech app using the Plaid API but are unsure where or how to start, or what resources you need, you’re in the right place. We can help you navigate all your questions about the available Plaid APIs and the associated costs of building your app. Don’t hesitate to connect with us today—we’re here to assist you!

What Is Plaid?

Plaid started in 2013 by Zach Perret and William Hockey, covers 12,000 financial institutions across the US, Canada, the UK, and Europe, and its Headquarters are situated in San Francisco.

Plaid is a fintech company that links applications to users’ bank accounts. It acts as an intermediary between financial institutions and developers, enabling the secure exchange of financial data.

Plaid has established itself as a leading player in the global open banking sector. It has been projected that the number of open banking users worldwide will exceed 132.2 million by 2024. However, open banking users are generally cautious about sharing their personal information with third parties.

In today’s competitive market, customer loyalty is essential for any business to succeed. Therefore, it is essential to understand how companies leverage open banking to create value. With Plaid banking, you can explore the possibilities of this service. If you want to ensure the security of your fintech product, Plaid is worth considering!

Key Highlights of Plaid:

1) Plaid is a financial technology firm that enables seamless communication between banking and credit card providers, as well as users’ financial services applications.

2) In the course of a transaction, Plaid ensures the confidentiality of your login details by establishing a secure line of communication with your bank.

3) Plaid asserts its utilization of top-notch encryption protocols to safeguard users’ information, prioritizing the protection of their sensitive data.

Key Aspects Of Plaid’s Role To Develop a Fintech App

Its primary focus is on creating infrastructure that facilitates the exchange of financial data between banks and third-party applications. Here are some key aspects of Plaid’s role in fintech:

1) Data Connectivity: Plaid acts as an intermediary that allows fintech applications to connect with users’ bank accounts. It provides a standardized API (Application Programming Interface) that developers can use to access financial data securely.

2) Transaction and Account Information: Plaid allows fintech apps to retrieve information about a user’s transactions, account balances, and other financial details directly from their bank accounts. This is crucial for various financial services, including budgeting apps, investment platforms, and personal finance management tools.

3) Identity Verification: Plaid’s services are often used for identity verification during the onboarding process for financial applications. By connecting to users’ bank accounts, Plaid helps verify their identity and financial credentials, enhancing security and reducing the risk of fraud.

4) Payment Initiation: In addition to accessing financial data, Plaid enables fintech apps to initiate payments directly from users’ bank accounts. This functionality is important for payment apps, peer-to-peer payment services, and other platforms that require the movement of funds.

5) Risk Assessment: Fintech companies leverage Plaid’s capabilities to assess the creditworthiness of users. By analyzing transaction history and financial patterns, Plaid helps in evaluating the risk associated with providing financial services or credit to users.

6) Compliance and Security: Plaid places a strong emphasis on security and compliance with financial regulations. It uses encryption and authentication measures to ensure the secure transmission of financial data. Fintech companies that integrate with Plaid can benefit from its robust security infrastructure.

7) Open Banking Initiatives: Plaid is aligned with the concept of open banking, promoting the idea that consumers should have control over their financial data and be able to share it securely with third-party applications. Open banking initiatives seek to promote innovation in the financial sector by fostering collaboration and competition.

8) Enabling Innovation: By providing a standardized and accessible way for fintech companies to connect with banking data, Plaid has played a crucial role in fostering innovation within the financial services industry. It has empowered a wide range of fintech applications to deliver innovative and user-friendly financial solutions.

Hence, Plaid serves as a key enabler for fintech innovation by facilitating secure and standardized access to financial data, streamlining processes such as identity verification, payment initiation, and risk assessment. Its role is instrumental in creating a more interconnected and efficient financial ecosystem.

It is important to note that the company collaborates with around 10,000 banks and holds a valuation in the millions of dollars. With a large consumer base worldwide and support for over 5,000 applications, Plaid plays a significant role in the fintech industry. Its mission involves securely packaging sensitive information obtained from payment or banking apps and transmitting it through secure channels for further processing.

Due to Plaid’s mission of digitalizing financial services and empowering fintech players, the company frequently garners media attention. For instance, Plaid recently launched a network called “Plaid Exchange” that aids fintech companies in combating fraud.

The Benefits of Fintech Apps Utilizing Plaid API:

- Viewing balances across multiple bank accounts.

- Initiating payments to friends.

- Applying for loans without the need to gather and scan bank and income statements.

- Paying for things online using a “Buy Now Pay Later” plan.

- Showing monthly income and expense categories to help set budgets.

- Displaying overall investment performance across multiple brokerage accounts.

Want To Validate Your App Idea? Want To Get A Free Consultation From An Expert?

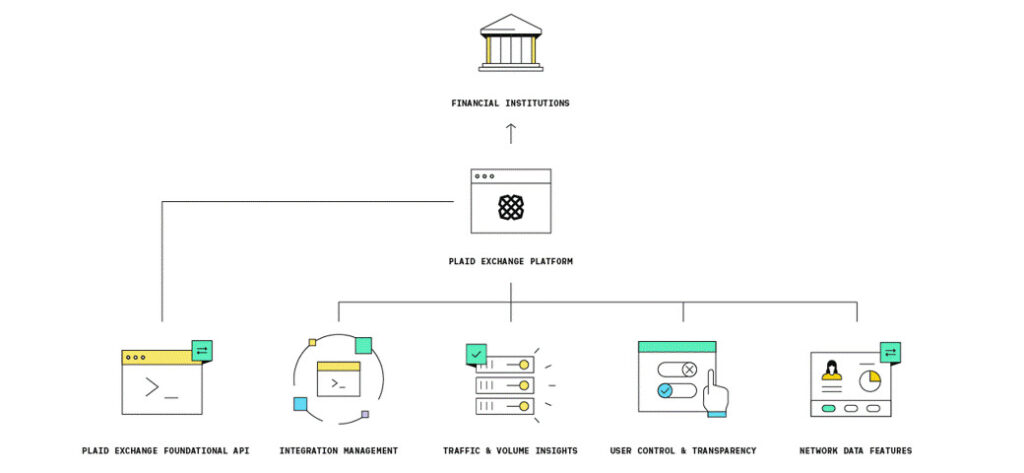

What is Plaid Exchange?

Plaid Exchange is a solution designed to assist financial institutions in constructing and managing an API that can be utilized by other developers. The platform’s core feature is the ability for consumers to maintain control and transparency over where and how their financial information is shared with third parties.

Over the past few years, the banking industry has made significant progress in forming partnerships with FinTech companies. This collaboration has necessitated a change in banks’ approach towards third-party access to user data. To enhance customer engagement, banks are now required to embrace the Open Banking initiative. Consequently, banking institutions will eventually need to integrate their services with third-party applications and delve into the world of APIs. However, not all banks possess the financial means and resources to develop their own APIs. This is particularly challenging considering that building an API in-house can be a lengthy and costly process, taking up to four years and costing between $10 million and $20 million annually. In light of this, Plaid has introduced Plaid Exchange.

Plaid Exchange offers banks the opportunity to implement their own API system without incurring exorbitant expenses. Prior to the introduction of Exchange, Plaid’s APIs relied on screen scraping to establish a connection with banks through a web browser hosted on Plaid’s server, which stored user information. However, this method proved to be inefficient as any updates to the bank’s website would disrupt data sharing and potentially break the integration. With Plaid Exchange, applications can directly connect with the bank through the API, eliminating the need for screen scraping. Furthermore, banks can leverage a modern token-based security system to ensure the safety of their customers’ information, while also granting them visibility and control over the sharing of their personal data and the connection of their accounts.

Plaid is renowned for its versatile banking API, which enables seamless integration between apps or services and bank accounts. For example, it facilitates the connection between your Cash App account and your bank account, allowing you to access relevant bank account details.

With Plaid Exchange, financial institutions can:

1) Easily create an API strategy by utilizing an out-of-the-box API solution that can be implemented quickly and efficiently.

2) They can also collaborate with Plaid to obtain essential tools for developer testing, risk management, and implementation.

3)Additionally, financial institutions can leverage token-based authentication to provide a more secure connection for users.

These capabilities enable financial institutions to empower their customers to give consent to share their financial information with popular third-party apps and services like Venmo, Coinbase, and Microsoft’s Money in Excel, among many other digital financial tools that consumers use to manage their financial lives.

How Does Plaid API System Work Behind the app?

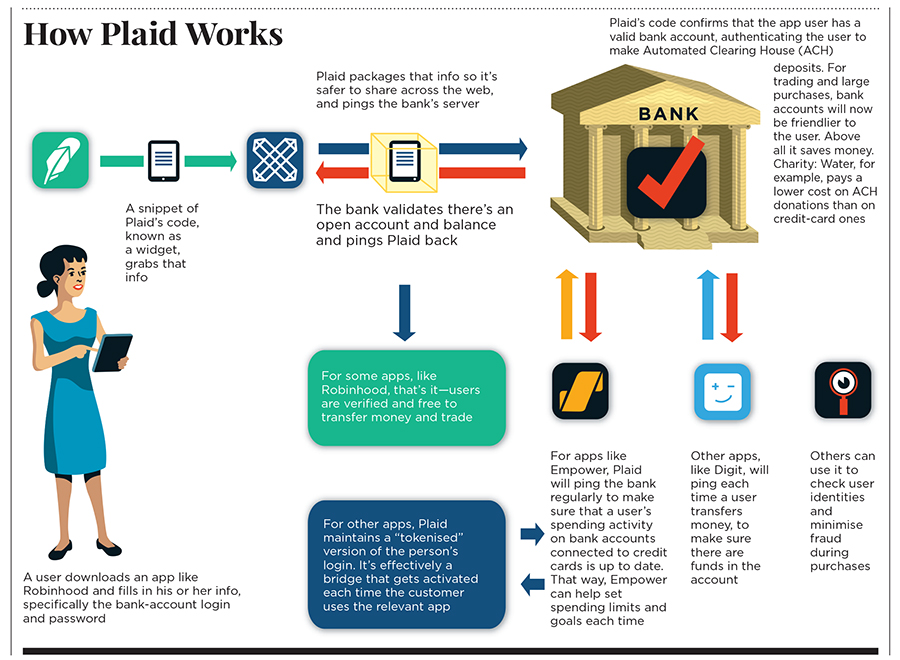

Here’s how Plaid APIs works:

We connect to 11,000 financial institutions across the United States, Canada, and Europe. With Plaid, connecting your bank account is easy: Step 1: Upon registering with a Plaid-enabled application, you will be presented with a list of financial institutions to choose from. Afterward, you will need to input your login credentials. Step 2: Within a few seconds, we will encrypt the data you have opted to share, such as your account balance, and safely transmit it to the desired application. We never disclose your login credentials to the application. Step 3: We operate in the background to establish a secure and continuous link between the application and your bank.Plaid uses encrypted, protected tokens to pull out user data. Plaid’s APIs use

- Advanced Encryption Standard (AES): For any stored data

- Transport Layer Security (TLS): For data in transit between apps

Plaid stores the following information:

- Account holder information

- Account transactions

- Account details

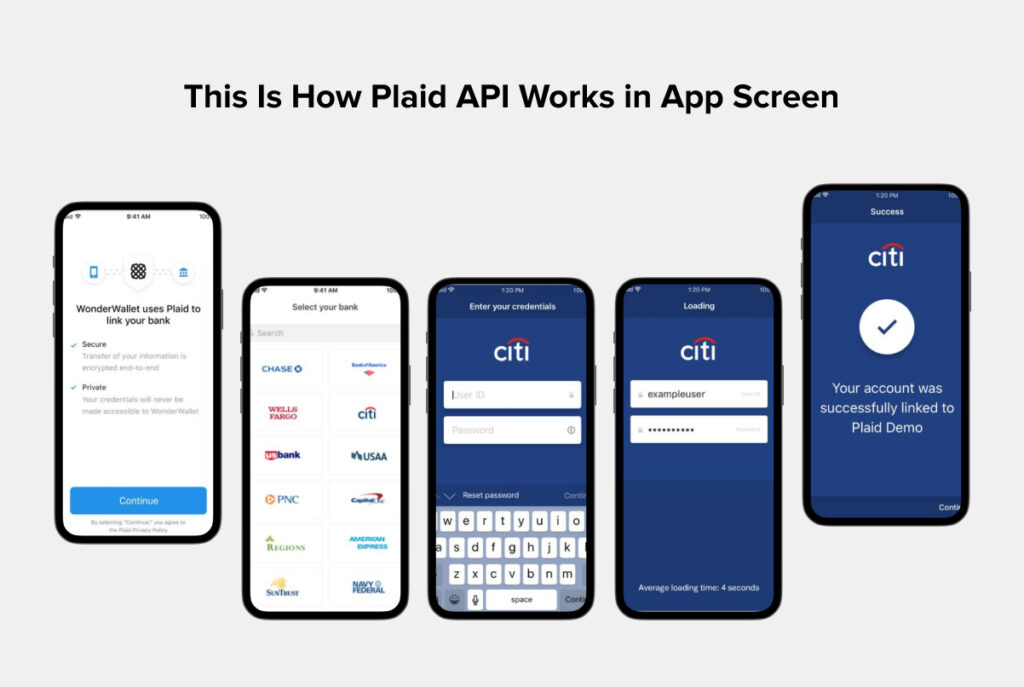

How plaid API works in fintech app?

Plaid works in a fintech app by providing a set of APIs (Application Programming Interfaces) that developers can integrate into their Mobile Applications. The goal is to enable these applications to securely and seamlessly connect with users’ bank accounts and access financial data. Here’s a general overview of how Plaid typically works within a fintech app:

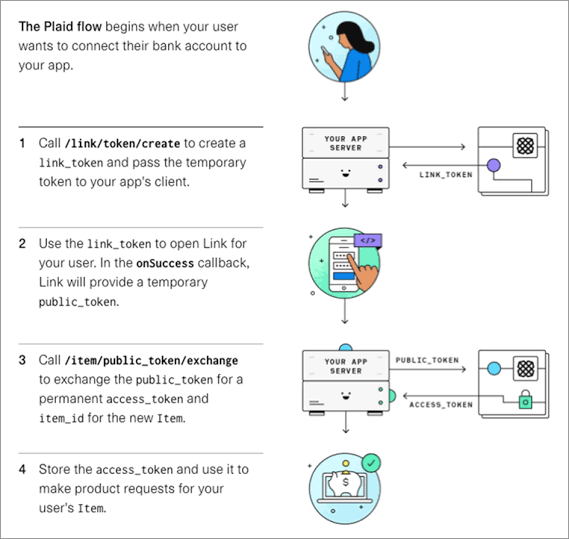

1) Integration: Fintech developers integrate Plaid’s APIs into their applications. This integration involves incorporating Plaid’s code into the app’s backend, allowing it to communicate with Plaid’s servers.

2) User Authentication: When a user decides to link their bank account to the fintech app, they are directed through an authentication process managed by Plaid. This process typically involves the user logging into their online banking account through a secure Plaid interface.

3) Tokenization: Once the user has authenticated their bank account, Plaid issues a secure access token. This token is used by the fintech app to make requests for financial data on behalf of the user. Importantly, the app never directly handles the user’s bank credentials; instead, it uses the token provided by Plaid.

4) Data Retrieval: The fintech app uses the token to make API calls to Plaid, requesting specific financial data such as account balances, transaction history, and other relevant information. Plaid then communicates with the respective financial institution to retrieve this data.

5) Data Standardization: Plaid normalizes and standardizes the financial data obtained from different banks. This is crucial because different banks may structure their data differently. Plaid ensures that the fintech app receives a consistent format, making it easier for developers to work with.

6) Data Presentation: The fintech app presents the financial data to the user in a user-friendly interface. This could include features like transaction categorization, spending insights, account balances, and more, depending on the app’s functionality.

7) Real-Time Updates: Plaid facilitates real-time updates of financial data. As users make transactions or experience changes in their accounts, Plaid ensures that the fintech app stays up-to-date with the latest information.

8) Payment Initiation (Optional): If the fintech app requires payment functionality, Plaid can also be used to initiate transactions. The app can request Plaid to facilitate transfers or payments from the user’s bank account.

9)Security Measures: Plaid employs robust security measures, including encryption and secure tokenization, to protect the sensitive financial data being transmitted between the user, the FinTech app, and the banks. This ensures that the information remains both secure and confidential.

10) Compliance: Plaid ensures that its services comply with relevant financial regulations and standards. This is important for fintech companies to operate legally and securely.

By leveraging Plaid’s infrastructure, fintech apps can provide users with a more streamlined and secure experience when it comes to accessing and managing their financial information. This integration also allows fintech companies to focus on building innovative features and services without having to deal with the complexities of direct integration with numerous banks.

How Do Stripe and Plaid API Work Together?

Stripe and Plaid often work together to provide a comprehensive solution for businesses in the fintech and online payment space. While they serve different purposes, their integration can enhance the overall functionality and user experience of applications that require both payment processing and access to financial data.

The integration of Stripe and Plaid allows fintech applications to provide a more robust and user-friendly experience by combining payment processing capabilities with secure access to users’ financial data. This collaboration enhances identity verification, Onboarding and KYC, Subscription Management, Risk Assessment with Innovation and Expansion supports regulatory compliance, and opens up opportunities for innovative financial services.

Is Plaid API Safe for Business?

The Plaid app ensures the utmost security when handling and transferring sensitive customer information. It employs state-of-the-art technologies such as Transport Layer Security (TLS) and Advanced Encryption Standard (AES 256) to guarantee the protection of data. Additionally, Plaid adheres to reliable security practices like multi-factor authentication (MFA) and a cloud infrastructure. These measures ensure that customer information remains secure at all times.

Plaid’s API enables seamless integration between applications and bank accounts, ensuring that no data is lost or overlooked. Users have the flexibility to customize the information displayed through the platform, including account profile details, balances, investment holdings, interest rates, student loans, transactions, account and routing numbers, and credit card balances.

Furthermore, Plaid strictly prohibits the sale of your or your customers’ private data to any third parties. With these robust security measures in place, you can trust that your information is safeguarded.

Plaid API: Frequently Asked Questions

Want to know more about Plaid API? Browse our FAQ to know your query. Or better yet – contact us to get your answers!

No, you can use other alternatives too, but as plaid popular so companies prefer plaid to use while building fintech app.

Using Plaid for banking is generally safe. Plaid adheres to strict security protocols to keep sensitive information away from fraudsters. Additionally, it allows consumers to see and manage the specific data they have shared.

Plaid does not charge consumers for using its services through Plaid-powered apps.

Plaid Transfer offers a comprehensive funds transfer solution for both payers and recipients within the United States. If you prefer to use a third-party payment processor, or if you or your counterparts are located outside the U.S., please refer to Plaid Auth for a “bring-your-own-processor” funds transfer solution.

Here are some popular alternatives:

- Yodlee API

- Finbox API

- Quandl API

- TrueLayer API

- Intuit QuickBooks API

- Open Bank Project

- Salt Edge API

The Plaid API is widely recognized as the most popular in the United States.

We have successfully created multiple applications utilizing the Plaid API for both Android and iOS platforms. Let’s connect and exchange our work, allowing you to gain valuable inspiration and receive the best suggestions and ideas from us.